Retainage is the portion of the contract price that a party, for whom work is being performed, reserves from each progress payment until a designated time following performance of the contract.[1] These reserved funds serve many purposes, including: (1) encouraging diligent completion of the work; (2) affording protection if a worker abandons the contract before completion; and (3) providing protection from the chance of litigation from wronged suppliers.[2] Due to its important role, retainage is required by either statute or contract for most construction projects.

Two forms of retainage are recognized in Texas—statutory and contractual. With the passage of House Bill 2237 (“HB 2237”), Chapter 53 of the Texas Property Code now refers to statutory retainage as “Reserved Funds” and contractual retainage as simply “Retainage”.[3]

Reserved Funds are a type of retainage created and required by statute. Chapter 53 of the Texas Property Code requires a property owner to reserve ten percent of the contract price during the progress of work under any contract for which a mechanic’s lien may be claimed.[4] If there is no set contract price, then the owner should reserve ten percent of the value of the construction or repair work performed.[5] The statute makes no distinction between residential and commercial projects. As such, the Supreme Court of Texas declared that an owner’s retainage duties are the same for both residential and commercial projects.[6]

The purpose of Reserved Funds is to secure the payment of those who provide labor or materials in the performance of work under a contract.[7] Generally, the property owner is responsible for paying the general contractor, and then the general contractor is responsible for using that money to pay the subcontractors. However, if the general contractor fails to compensate the subcontractors for their work or materials, the subcontractors may have a claim to the Reserved Funds.

Generally, under Texas law a subcontractor does not have a direct right to a lien against an owner’s property.[8] However, a property owner who fails to or refuses to withhold ten percent of the contract price as Reserved Funds risks exposure to liens against the property and its improvements.[9] This results in personal liability exposure for the homeowner in an amount equal to what they were required to retain as Reserved Funds.

In addition, a failure to retain the Reserved Funds may extend the period in which a subcontractor can file a lien. Generally, a subcontractor claiming a lien against Reserved Funds is required to do so within 30 days of completion of the work.[10] However, a failure to retain the Reserved Funds may render the 30-day limited period for filing a lien inapplicable.[11]

Compliance with Chapter 53 of the Property Code and retaining ten percent of the contract price as Reserved Funds is the best way a property owner can minimize his exposure to personal liability.

The Texas Property Code only requires Reserved Funds for contracts between the property owner and the general contractor. This means that the Reserved Funds requirements do not automatically flow down to contracts between the general contractor and the subcontractors and/or suppliers.[12] To help bridge this gap, Retainage (formerly contractual retainage) provisions may be included in subcontracts. Like Reserved Funds, Retainage provisions help to ensure completion of the work in accordance with both the subcontract and the owner’s standards.

Retainage allows general contractors to pass down some of the burden that Reserved Funds impose on them.[13] Reserved Funds may create cash flow problems for general contractors, especially those in residential construction. To help mitigate this, general contractors can include Retainage provisions in their subcontracts. Retainage provisions generally allow general contractors to retain ten percent of the subcontract price throughout the course of the project or until the Reserved Funds are paid to them.[14]

While Retainage provisions help general contractors reduce cash flow problems, they also help ensure payment of subcontractors and suppliers. Generally, a property owner may make its final payment, including the Reserved Funds, to the general contractor within 30 days of completion of the project.[15] However, if a subcontractor has provided the property owner notice of contractual Retainage, the property owner should not make the final payment until the deadline to file a lien for Retainage has passed.[16] Additionally, a property owner put on notice of a claim for Retainage may withhold funds, in addition to any Reserved Funds, necessary to pay the claim.[17]

Additionally, contractual Retainage may extend the time period in which a subcontractor or supplier must file a lien. This is because instead of the claim accruing once the subcontractor completes its work under the subcontract (as it would for a lien not for retainage)[18], the claim for Retainage does not accrue until the contract between the property owner and general contractor is completed or terminated.[19] This may result in a property owner becoming personally liable to a subcontractor who has complied with the notice and filing requirements for a lien for unpaid Retainage.[20]

Despite it being a statutory requirement and the hefty consequences that may result from a violation, most residential construction contracts disclaim Reserved Funds.[21] This is often due to builders refusing to allow for Reserved Funds, listing cash flow problems as their reason for resisting the statutory requirement. However, in the event a subcontractor is not paid, a contractual disclaimer signed by only the general contractor likely will not prevent the homeowner from being exposed to personal liability.[22] The only way for a homeowner to truly limit their exposure is to comply with the statute and retain ten percent of the contract price.

In the event a property owner must enter into an agreement with a general contractor who refuses to allow for Reserved Funds, the property owner should insist on partial lien waivers and releases from everyone involved. These waivers and releases will function as a condition precedent to each payment made by the homeowner. To ensure compliance, the property owner should include in the construction contract a provision similar to the following:

As a condition precedent to payment on each of Contractor’s pay applications, Contractor shall provide to Owner a Partial Lien Waiver and Release for each subcontractor and/or supplier that has been paid for the time period of such pay application, or will be paid from the proceeds of such pay application.[23]

It is important to note that waivers and releases must be completed by every subcontractor and supplier for each progress payment and the final payment. More information on the requirements and form of the waivers and releases can be found in Tex. Property Code Ann. §§ 53.282; 53.284.

A subcontractor or supplier is entitled to a lien on Reserved Funds if the claimant (1) sends the notices as required by Chapter 53 of the Property Code; and (2) files an affidavit claiming a lien within 30 days of when the work is completed.[24]

Procedural Requirements. Subcontractors and suppliers are “Derivative Claimant[s]” and must provide notice prior to filing a lien affidavit.[25] Derivative Claimants must provide written notice of a claim for unpaid labor or materials to both the property owner and the general contractor.[26]

The deadline for providing notice begins to run on the date that labor or materials were last provided by the Derivative Claimant.[27] For residential construction projects, the Derivative Claimant must provide notice by the 15th day of the second month. For commercial construction projects, the Derivative Claimant must provide notice by the 15th day of the third month.[28] The following table provides a summary of the notice deadlines:

|

If Indebtedness Accrues in: |

Notice Must be Given By [Residential]: |

Notice Must be Given By [Commercial]: |

|

January |

March 15th |

April 15th |

|

February |

April 15th |

May 15th |

|

March |

May 15th |

June 15th |

| April |

June 15th |

July 15th |

|

May |

July 15th |

August 15th |

|

June |

August 15th |

September 15th |

|

July |

September 15th |

October 15th |

|

August |

October 15th |

November 15th |

|

September |

November 15th |

December 15th |

|

October |

December 15th |

January 15th |

| November | January 15th |

February 15th |

| December | February 15th |

March 15th |

Substantive Requirements. The notice provided to the general contractor and property owner must contain language similar to the following:

NOTICE OF CLAIM FOR UNPAID LABOR OF MATERIALS WARNING:

This notice is provided to preserve lien rights. Owner’s property may be subject to a lien if sufficient

funds are not withheld from future payments to the original contractor to cover this debt.[29]

In addition to the previously quoted language, the notice must contain the following nine items: (1) the date, (2) project description and/or address, (3) claimant’s name, (4) type of labor or materials provided, (5) general contractor’s name, (6) party with whom claimant contracted if different from the general contractor, (7) claim amount, (8) claimant’s contact person, and (9) claimant’s address.[30]

A Derivative Claimant has provided proper notice of a claim to Reserved Funds if he complies with the above described procedural and substantive requirements. Strict compliance is required for the procedural requirements, and substantial compliance is required for the substantive requirements.

A Derivative Claimant must file an affidavit claiming a lien on Reserved Funds within 30 days of the earliest of the following events: “work is completed[,] the original contract is terminated[,] or the original contractor abandons performance under the original contract.”[31] The completion of “work” that triggers the 30-day period is the completion of the original contract; not the completion of the Derivative Claimant’s work.[32] This allows the deadline for filing an affidavit to align with the 30 day period in which the property owner must retain funds following the completion of the project.[33]

To ensure Derivative Claimants can comply with the filing deadlines, Chapter 53 of the Property Code requires property owners to file an affidavit of completion within ten days of when the project is completed.[34] The property owner must then send notice of completion to any Derivative Claimants who have provided proper notice of claims to the owner.[35] The filing of the affidavit of completion serves as prima facie evidence of the date that triggers the 30-day deadline for a Derivative Claimant to file a lien against the Reserved Funds.

The affidavit claiming a lien against the Reserved Funds must be signed by the claimant, contain copies of the notices sent to the owner, and contain the following

(1) a sworn statement of the amount of the claim;

(2) the name and last known address of the owner or reputed owner;

(3) a general statement of the kind of work done and materials furnished by the claimant and…a statement of each month in which the work was done and materials furnished for which payment is requested;

(4) the name and last known address of the person by whom the claimant was employed or to whom the claimant furnished the materials or labor;

(5) the name and last known address of the original contractor;

(6) a description, legally sufficient for identification, of the property sought to be charged with the lien;

(7) the claimant’s name, mailing address, and, if different, physical address; and

(8)… a statement identifying the date each notice of the claim was sent to the other and the method by which the notice was sent.[36]

A Derivative Claimant who has complied with the above-mentioned notice and affidavit filing requirements is entitled to a lien against the Reserved Funds. Again, strict compliance is required for the filing and notice deadlines, while substantial compliance is required for the substantive requirements

A subcontractor or supplier whose subcontract provides for Retainage is entitled to a lien for unpaid Retainage if the claimant (1) sends notice as required by Section 53.057 of the Property Code; (2) timely files an affidavit; and (3) provides notice of the filed affidavit as required by Section 53.055 of the Property Code.[37]

Procedural Requirements. A Derivative Claimant whose subcontract provides for Retainage must provide written notice of a claim for unpaid retainage to both the property owner and the general contractor.[38] For both residential and commercial construction projects, the Derivative Claimant must send notice within 30 days of the occurrence of the earlier of the following two events: (1) claimant’s subcontract is completed, terminated, or abandoned; or (2) the original contract is terminated or abandoned.[39] Strict compliance with the notice deadline is required for a valid lien.

Substantive Requirements. The notice a claimant must provide for a claim for unpaid Retainage should contain language similar to the following:

NOTICE OF CLAIM FOR UNPAID RETAINAGE WARNING:

This notice is provided to preserve lien rights. Owner’s property may be subject to a lien if sufficient

funds are not withheld from future payments to the original contractor to cover this debt.[40]

In addition to the previously quoted language, the notice must contain the following nine items: (1) the date, (2) project description and/or address, (3) claimant’s name, (4) type of labor or materials provided, (5) general contractor’s name, (6) party with whom claimant contracted if different from the general contractor, (7) total retainage unpaid, (8) claimant’s contact person, and (9) claimant’s address.[41]

A Derivative Claimant has provided proper notice of a claim for unpaid Retainage if he complies with the above described procedural and substantive requirements. Strict compliance is required for the procedural requirements, and substantial compliance is required for the substantive requirements.

A Derivative Claimant claiming a lien for unpaid Retainage must file a lien with the county clerk by the 15th day of the third month following the month in which the original contract was completed, terminated, or abandoned.[42] The following chart provides a summary of when the affidavit must be filed to claim a lien for unpaid Retainage:

|

If Original Contract was Completed, Terminated, or Abandoned in: |

Lien Affidavit Must be Filed By: |

|

January |

April 15th |

|

February |

May 15th |

|

March |

June 15th |

|

April |

July 15th |

| May |

August 15th |

|

June |

September 15th |

| July |

October 15th |

| August |

November 15th |

|

September |

December 15th |

|

October |

January 15th |

| November |

February 15th |

|

December |

March 15th |

The affidavit claiming a lien for unpaid Retainage must be signed by the claimant, contain copies of the notices sent to the owner, and contain the following:

(1) a sworn statement of the amount of the claim;

(2) the name and last known address of the owner or reputed owner;

(3) a general statement of the kind of work done and materials furnished by the claimant and…a statement of each month in which the work was done and materials furnished for which payment is requested;

(4) the name and last known address of the person by whom the claimant was employed or to whom the claimant furnished the materials or labor;

(5) the name and last known address of the original contractor;

(6) a description, legally sufficient for identification, of the property sought to be charged with the lien;

(7) the claimant’s name, mailing address, and, if different, physical address; and

(8) … a statement identifying the date each notice of the claim was sent to the other and the method by which the notice was sent.[43]

Finally, to ensure that the claimant has a lien and the property owner is personally liable for an amount equal to the Reserved Funds, the claimant must provide notice of the filed affidavit.[44] To satisfy this final requirement, the claimant must send a copy of the affidavit claiming a lien for unpaid Retainage to both the property owner and the general contractor within five days of filing the affidavit.[45]

A claimant who has sent proper notice of his claim, timely filed an affidavit, and then provided proper notice of the filed affidavit has a valid lien for unpaid Retainage. If the property owner failed to retain the funds necessary to satisfy the lien, the property owner is personally liable to the claimant for the amount of the Reserved Funds.[46]

|

|

RESERVED FUNDS |

RETAINAGE |

|

Notice |

Notice must be given in the 2nd (residential) or 3rd (commercial) month following the date that labor or materials were last provided |

Notice must be given within 30 days of the earlier of the following two events: (1) completion, termination, or abandonment of the subcontract; or (2) termination or abandonment of the original contract |

| Affidavit Filing | The affidavit must be filed within 30 days of the date that the original contract is completed, terminated, or abandoned. |

The affidavit must be filed by the 15th day of the 3rd month following the completion, termination, or abandonment of the original contract. |

Despite the long history of using retainage in construction contracts[47], Texas’ law on retainage continues to receive legislative attention with the latest changes coming from the 87th Legislature’s passage of HB 2237. The changes implemented through HB 2237 only apply to construction projects with an original contract entered into on January 1, 2022 and thereafter. Projects with original contracts entered into before January 1, 2022 are not affected by the changes in HB 2237. The following provides a brief summary of some of the most notable changes.

Delivery of Notice. The revised act appears to expand the methods that can be used to provide notice under Chapter 53 of the Property Code. The act now allows for notice to be delivered in person, by certified mail, or by any other form of traceable, private delivery or mailing service that can confirm proof of receipt.[48]

Deadlines Extended by Weekends and Holidays. The revised act now includes a provision stating that if any deadline falls on a Saturday, Sunday, or legal holiday, the deadline is extended to the next day that is not a Saturday, Sunday, or legal holiday.[49]

Licensed Professionals and Landscapers. The scope of persons entitled to liens has been expanded to include licensed architects, engineers, and surveyors providing design services.[50] Due to this amendment, the act no longer requires architects, engineers, and surveyors to have contractual privity with the property owner to have lien rights.

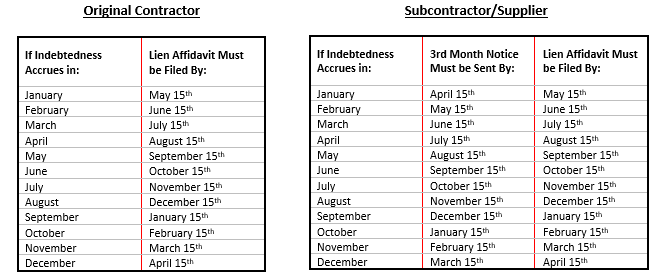

Second Tier Subcontractors’ Notice. The revised act no longer distinguishes between first and second tier subcontractors. All subcontractors and suppliers, regardless of if their contract is with the general contractor or another subcontractor, are subject to the same notice and filing deadlines.[51] A summary of the updated notice and filing deadlines is provided below:

One-Year Statute of Limitations. The act no longer distinguishes between residential and commercial construction projects in regard to the statute of limitations for foreclosing on a lien.[52] The act now provides that a suit to foreclose the lien must be brought within one year if no agreement to extend the limitations period has been entered.[53]

The best way to limit exposure to personal liability for unpaid subcontractors is to comply with the statute and retain ten percent of the contract price as Reserved Funds. It is also important to ensure that you retain the Reserved Funds and any additional funds withheld for unpaid Retainage until the deadline to file a lien has passed.

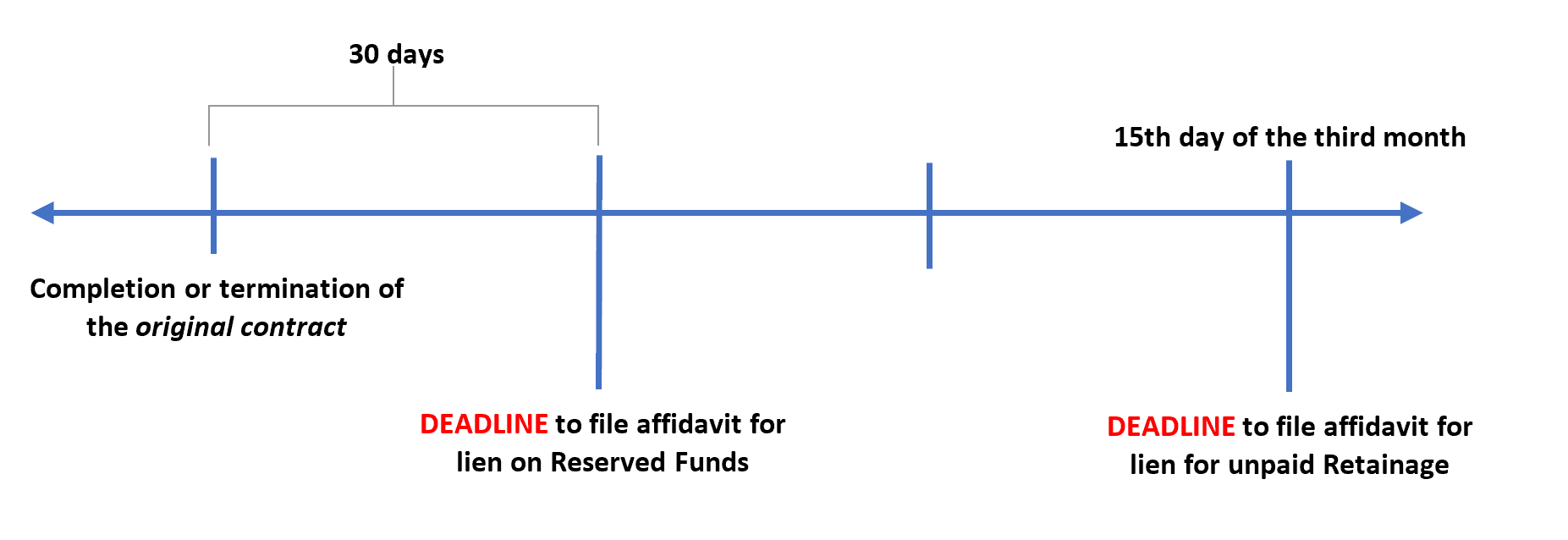

The deadline for a claimant to file a lien against Reserved Funds is 30 days after the date that the original contract is completed, terminated, or abandoned. The deadline for filing a lien for unpaid Retainage is the 15th day of the third month following the completion, termination, or abandonment of the original contract. If you have not received notice of a claim for unpaid Retainage by the 30th day following the completion of the original contract, it is likely okay to release the Reserved Funds.

While contractual Retainage provisions in a subcontract delay a portion of your payment for labor or materials provided, they provide protection in the event of nonpayment. Retainage provisions allow the property owner to retain a portion of the general contractor’s payment in the event of nonpayment if the proper steps are taken by the subcontractor.

While the notice and filing deadlines vary for the types of liens a subcontractor may claim, in the event on nonpayment, it is safest for a subcontractor to provide notice for all claims he may have within 30 days of the date labor or materials were last provided. This should allow the subcontractor to comply with the notice deadlines for a normal lien, a lien on Reserved Funds, and a lien for unpaid Retainage if applicable.

If the proper notice was given in advance, the following is a timeline of when a subcontractor must file the various lien affidavits:

[1] The Texas Property Code defines retainage as “an amount representing part of a contract payment that is not required to be paid to the claimant within the month following the month in which labor is performed, material is furnished, or specifically fabricated material is delivered.” Tex. Prop. Code Ann § 53.001(11).

[2] Econ. Forms Corp. v. Williams Bro. Const. Co., Inc., 754 S.W.2d 451 (Tex. App.—Houston [14th Dist.] 1988, no writ).

[3] Tex. Prop. Code Ann. §§ 53.001; 53.102.

[4] Tex. Prop. Code Ann. § 53.101.

[5] See Hayek v. W. Steel Co., 478 S.W.2d 786, 793 (Tex. 1972).

[6] See Page v. Structural Wood Components, Inc., 102 S.W.3d 720 (Tex. 2003).

[7] Tex. Prop. Code Ann. §53.102.

[8] See Stolz v. Honeycutt, 42 S.W.3d 305, 310 (Tex. App.—Houston [14th Dist.] 2001, no pet.).

[9] Tex. Prop. Code Ann. § 53.105(a).

[10] Tex. Prop. Code Ann. § 53.103.

[11] See General Air Conditioning Co. v. Third Ward Church of Christ, 426 S.W.2d 541, 544 (Tex. 1968).

[12] §5:19. Retainage in Residential Construction, Texas Residential Construction Law Manual (December 2021).

[13] §1:11. Retainage Generally, Texas Residential Construction Law Manual (December 2021).

[14] See, e.g., Indus. Indem. Co. v. Zack Burkett Co., 677 S.W.2d 493, 494 (Tex. 1984).

[15] Tex. Prop. Code Ann. §53.101.

[16] Tex. Prop. Code Ann. §53.082.

[17] Tex. Prop. Code Ann. §53.081.

[18] Tex. Prop. Code Ann. §53.052.

[19] Tex. Prop. Code Ann. §53.052(d).

[20] Tex. Prop. Code Ann. §53.057(f).

[21] §1:11. Retainage Generally, Texas Residential Construction Law Manual (December 2021).

[22] Tex. Prop. Code Ann. § 53.282; See Eason v. Calvert, 902 S.W.2d 160 (Tex. App.—Houston [1st Dist.] 1995, writ denied) (“A contract the terms of which violate the constitution, statutes or regulations promulgated thereunder is illegal and unenforceable.”).

[23] §1:11. Retainage Generally, Texas Residential Construction Law Manual (December 2021).

[24] Tex. Prop. Code Ann. §53.103.

[25] Tex. Prop. Code Ann. §53.056.

[26] Id.

[27] Id.

[28] Id.

[29] Id.

[30] Id.

[31] Tex. Prop. Code Ann. §53.103.

[32] See Page v. Structural Wood Components, Inc., 102 S.W.3d 720 (Tex. 2003).

[33] See id. at 722.

[34] Tex. Prop. Code Ann. §53.106

[35] Id.

[36] Tex. Prop. Code Ann. §53.054.

[37] Tex. Prop. Code Ann. §53.057.

[38] Id.

[39] Id.

[40] Tex. Prop. Code Ann. §53.057.

[41] Id.

[42] Tex. Prop. Code Ann. §53.052.

[43] Tex. Prop. Code Ann. §53.054.

[44] Tex. Prop. Code Ann. §53.057.

[45] Tex. Prop. Code Ann. §53.055.

[46] Tex. Prop. Code Ann. §53.057.

[47] Texas case law addressing retainage provisions dates back to the early 1900s. See El Paso & S.W.R. Co. v. Eichel & Weikel, 130 S.W. 922 (Tex. Civ. App. 1910), writ dismissed w.o.j. sub nom. El Paso & S.W. Ry. Co. v. Eichel & Weikel, 226 U.S. 590, 33 S. Ct. 179, 57 L. Ed. 369 (1913).

[48] Tex. Prop. Code Ann. §53.003.

[49] Id.

[50] Tex. Prop. Code Ann. §53.021.

[51] Tex. Prop. Code Ann. §§ 53.052; 53.056; 53.057.

[52] Tex. Prop. Code Ann. §53.158.

[53] Id.

West Mermis provides practical legal solutions for our clients in the construction industry. Our attorneys have proven courtroom experience before federal and state courts, and routinely represent clients in high-stakes commercial arbitration. We provide high-quality legal advice throughout the life cycle of construction projects, prioritizing the business interests of our clients.